Update from the original, posted on 2014-10-06: this article has been getting a bit of attention, so I've updated it with more current information.

If you found your way here looking for a freelance software developer, check out my work at www.disconnectionist.com or email me.

This is how different governments treat their citizens:

AUSTRALIAN GOVERNMENT: "No worries, mate! We'll leave you alone to go and make us lots of tax money. We don't even know or care where you live right now. But if we check later and catch you cheating, you're GONE!"

FINNISH GOVERNMENT: "Here is some horribly complicated tax form that not even your Finnish friends can understand, but we've already filled it out for you automatically. We also want to give you some money. If you have a problem with this, please write back with the attached form. Otherwise, do nothing."

GERMAN GOVERNMENT: "You are a bad person just waiting for a chance to do something wrong. Therefore, we are going to frustrate your every attempt to do something novel, make you give tedious accounts of every step you take, and even interrogate you about your religious beliefs. As soon as you've managed to take your mind off us, we will remind you with some nasty letter that we are still watching you."

German society does chug along OK, and people are generally looked after here, but I find it tragic that so much time is wasted on an excess of bureaucracy here. Things could be so amazingly better! I'm an engineer, and part of my job is to streamline processes to be as efficient as possible. Sometimes, applying more rigid processes to a problem is an excellent solution, but often it's the worst move ever. Applying more process to fix process issues is like treating a choking patient by wrapping more bandages around their face. Everyone is choking on paperwork in Germany, at every step of their lives.

I want people to be unburdened from pointless paperwork, freeing them to do useful work for society. I want a worker who is being abused by their boss to be able to walk out of their job, without fear of being drowned by compulsory health insurance costs.

We have the technology and expertise to fix this, and other countries have solved it; we all just need to show the finger to the vested interests who benefit from this status quo (Germany has the most unequal wealth distribution in Europe), pick up the sword and smash that Gordian Knot. I fear this will take generational change; Germany has the second oldest population in the world.

At least you will be in good company: everyone hates bureaucracy, and I've found people here to be so patient and helpful when it comes to sorting out paperwork problems. So, how do you start as a freelancer in Germany today?

If you can, start a business anywhere but in Germany. It's a country set up for big auto manufacturers, not for entrepreneurs. I've heard worse things about other countries, so it's all relative, but Germany is definitely not a meritocracy in the league of the English-speaking countries. I would describe myself politically as leaning towards Social Democracy, but the unfriendly political and administrative climate for freelancers in Germany makes me feel like the beleaguered protagonist of an Ayn Rand novel.

So you still want 2.50e kebabs, to ride your fixie between startup meetings and gallery openings, 3pm breakfasts, and to pretend you like techno in smoky basements? Here's the guide to freelancing in Berlin.

I'm assuming you've got your visa situation sorted and have registered with the Buergeramt (you're here illegally if you don't do it within 2 weeks).

Note that I'm not an accountant, lawyer, or immigration advisor, so seek professional advice for all this. I still get regularly harassed and tangled up by the bureaucracy, so this advice probably isn't pure gold.

Note that this will differ by industries. I am a software engineer, which is about the most lightweight business class in Germany. Tradespeople probably need to pay trade taxes and guild dues. Get a tax adviser who specialises in your industry.

Extra pain awaits anyone who does anything creative. If you are contracting any sort of creative person in the German system (ie, a musician, designer, or performer), you may have to pay 5% of what you pay them into an artists' social fund (the KSK); even if they are not a member of the fund! Instead of just providing subsidies out of the federal budget, or even not having such a crazy, inefficient welfare system in the first place (see below), you personally need to pay 5% of what you pay a German artist into this fund. Not only does this cripple German artists' ability to get work compared to other nationalities, as an employer you will waste time doing extra paperwork - forever. So either never, ever employ a German artist, or be prepared to grit your teeth and deal with more red tape and costs.

I think I've vented most of my frustration with "Der Prozess", so let's get on with it.

In Australia, health insurance is mainly for hypochondriacs who want to get cheaper glasses or teeth whitening. Everything else is paid for by the state, and fantastic treatment it is too. In Germany, health insurance is compulsory, and as a German freelancer you need to pay it out of your own pocket. It's like Obamacare-done-sort-of-right. My first conversation when looking for healthcare went like this:

Them: "our basic cover is 350 euros."

Me: "gee, it sounds a bit much. Are you sure you don't have anything cheaper? I guess I can pay that much in a year if I have to."

Them: "That's per month."

That's right. 4200 euros a year for the privilege of running a small business in Germany. So it may just be a better business plan to buy a round-round-the-world ticket and drink mojitos in the Caribbean all year.

If you don't have insurance, or don't have the right one, you will be fined for the cost of the insurance from the time you entered Germany. Ouch. Travel insurance doesn't count.

It's tax deductible, but this is a huge disincentive for starting a business in Germany; you might be lucky to make this amount in your first year of doing business in cash-strapped Berlin. However, I think of it as "protection money" that you pay to a special friend of the government, to keep potential competitors away. This system keeps them stuck in day jobs they hate, or sends them fleeing on the next bus to Lithuania, London, or Estonia, to start their business there instead.

If you get sick, you also might need to deal with posting receipts around, paying for treatment out of your own pocket, or arguing with insurance companies, which wastes time and is the last thing you want to do when you are recovering. I won't get too deeply into the complexities of Germany health insurance; it's best to talk to someone who knows the system well. But make sure it is someone who won't take a commission for signing you up somewhere.

Before I get a flame-storm of Germans defending their healthcare system: private healthcare systems give the absolute worst value for money: US, Germany, and Netherlands.

Even worse is the possibility of freelancers being hit with compulsory pension contributions. The German government is always sniffing around for ways to force people into this, which could double your fixed costs. A couple of years ago they tried to do it en masse, but it was shot down by German businesses; all the freelancers in Germany would have immediately packed their bags for some other country, leaving nobody to do any work.

My experience with traditional German banks has been horrible. I once had the displeasure of being called to an "important meeting" with my bank, only to have them try and sell me insurance for 45 minutes. Even worse, they based their sales pitch on my personal transactions, which they were bold enough to dig through right in front of me. If it isn't actually illegal, to me it is unbelievably unethical. So I am trying to shift to purely online free banking.

Update: I now recommend you to get a free online business account. Just make sure it is a business account, as it may breach your bank's Terms and Conditions to use a personal account for business. Purely online accounts like the fantastic N26 (sign up for their "business" account, and then filter your expenses and income by "business expenses" to keep your personal finances separate) and DAB Bank are blowing away the traditional German banks.

If you've done the previous steps, it's time to actually set up your business. The first step is to get a good tax consultant (Steuerberater). This is unnecessary in most countries, but not in Germany; the more you pay these guys, the less time you will spend sitting in dusty government offices, up to your neck in paperwork, or having your butt kicked by the Finanzamt. Just hand it all over to them.

I checked out some sloppy-looking tax consultants who seemed to assume I was just going to give them their business because the government was basically forcing me to, but there are better and worse ones. It's worth shopping around to find one with good customer service. If they seem angry that you spent 10 minutes of their time to discuss their services, without them being able to hit you with a consultation fee, move on.

You can't work at all unless you have a VAT (MwSt in German) number.

Even with a tax consultant, you will need to use Elster, an online system for registering your VAT every month. The form for VAT is 10+ pages long, but you only need to worry about three sections in most cases. Please check with your tax consultant, and get them to do your first few as an example. It might be different for you, but here they are:

You also need to declare any VAT transactions between EU countries quarterly (that reminds me!). This can also be done through Elster.

That's right - you need to do this boondoggling every month. One month of tax paperwork in Germany as a freelancer, even with a tax consultant, is as much work as a year's worth of tax paperwork in Australia as a company director plus freelancer, with no tax consultant. No wonder there's a euro crisis.

Now for the only "good news" update to this article: once you've run your business for a year, you will probably be able to switch to doing quarterly paperwork. As always, Germany favours the incumbents, by unfairly penalising all of your potential new competitors.

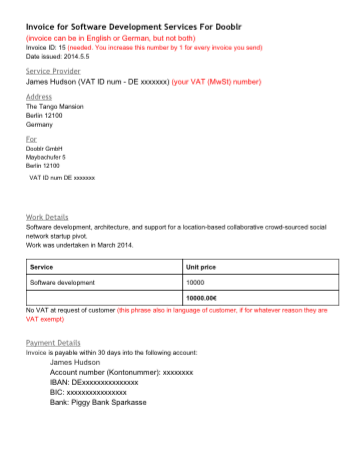

I've included a template invoice in the link below; you might want to use it as a basis for your own.

An invoice acceptable to the German tax system needs lots of compulsory information. Make sure yours has all the information that I have added, and then run it past your Steuerberater to be sure. My comments in red:

I was shocked to invoice an Australian customer with my old Australian invoice template recently. It was basically no more than "I did some work and this is how much it cost - here's my business number". However, the German one does make you feel very official and serious.

Keep all your accounts in spreadsheets: every cent should be accounted for: invoices and expenses, broken down into net, gross, and VAT. One benefit of running a business in Germany is that you'll learn impeccable bookkeeping.

Thousands of euros a year in registration fees, double-entry bookkeeping, the need to hire an accountant... don't even bother, unless you are planning on opening a car factory. You are already at the first circle of hell with a German business, why go further?

Estonia has just announced e-residency for those not even living in Estonia. Take advantage of their streamlined online governmental systems, and start a company online in ten minutes. Note to the German government: get your act together, or half your citizens will become e-Estonians next year and start paying taxes there instead. Estonia is also a beautiful country with smart, hardworking people, so you might even want to drop the e- prefix from e-residency.

Britain has a very lightweight system for running a company, and I've heard you can still do business in Germany with it after paying a fee to the German government. Update: the German tax department is well aware of this, and will most likely be cracking down on anyone trying to use a better government. Be very careful if you are both living and working in Germany, but registering a company elsewhere. Get a lawyer to try and work out the details; I am definitely not one.

Once you have all the different pieces of your business set up and working, the burden of bureaucracy is tolerable. The first 12 months are the toughest, so if you and your business survive that long, things will get easier. I'm still in Berlin, after all, and not already in Australia, Eastern Europe, or London. You can pay people to make all these problems disappear once you have a decent income stream.

And if you can run a freelance business in Germany, you will gain enough administration skills to run a whole company in another country. Really.

So, here are the steps to start freelancing in Berlin, in order:

And like everything in Germany involving bureaucracy: just follow all the steps to the letter, no matter how ridiculous they seem, and everything will work out OK in the end. One positive aspect of freelancing in Germany is that the complexity and costs of setting up a business are a big barrier to entry for any potential competitors. You will also impress your foreign customers with your comprehensive invoices and precision bookkeeping. Good luck!

James Hudson

If you have any thoughts on this, please email me. Or at least "like" or "share" this post if you think others would appreciate it.

Needless to say, this blog isn't financial or legal advice, an excuse for getting fired, or promising that any of these ideas will work for you. The companies or people I mention may not agree with my opinions here. Don't do anything reckless, damaging or hurtful to anyone! In the future you might need your bridges unburnt. Images used under fair use, and are copyright their respective owners. © 2014-2022 James Hudson